Medigap Benefits Things To Know Before You Get This

How Medigap Benefits can Save You Time, Stress, and Money.

Table of ContentsThe Greatest Guide To Medigap BenefitsAn Unbiased View of Medigap BenefitsThe Ultimate Guide To Medigap BenefitsThe smart Trick of Medigap That Nobody is Talking About5 Easy Facts About Medigap Benefits Described

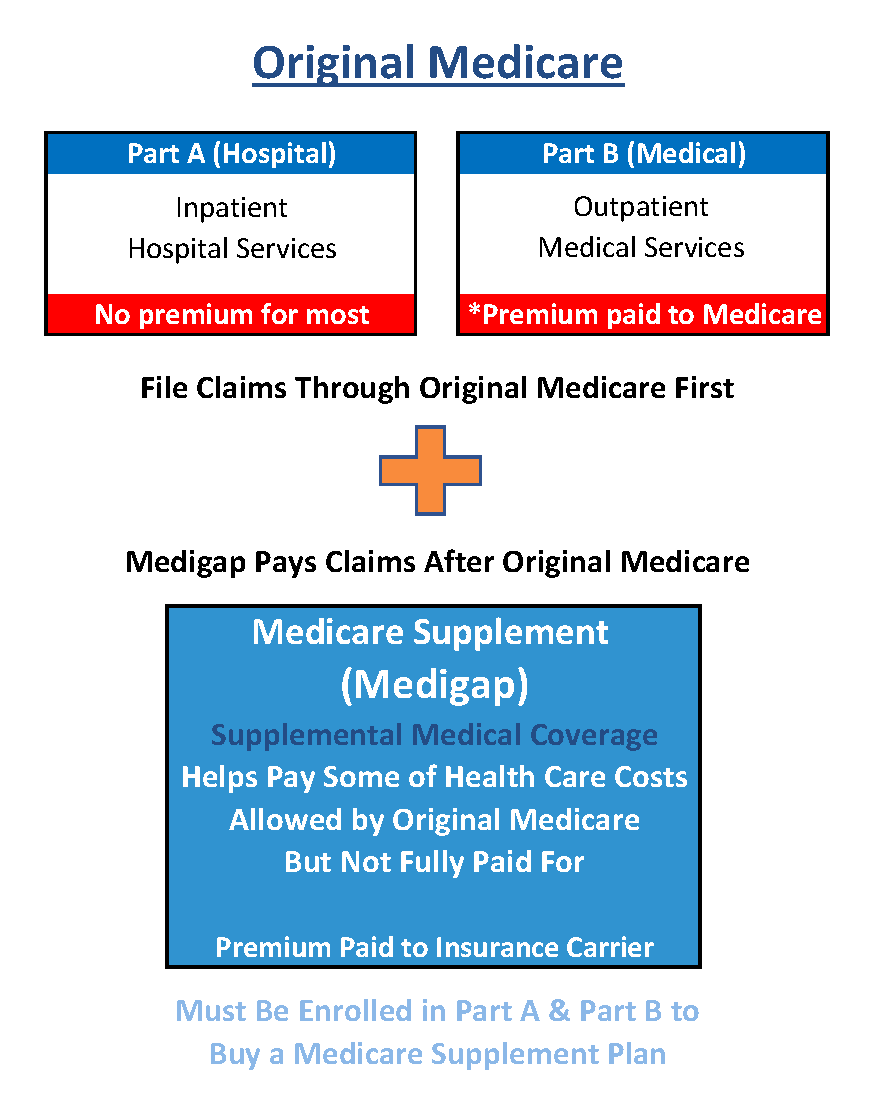

A strategy may cover only 75% instead than 100% of the Medicare Component A deductible. Depending on your income level, the state Medicaid program might pay component or all of your Medicare Component B costs, as well as potentially various other expenses. If you have Medicare Component D, Roland recommends looking for Additional Assistance, a government aid with repayment help for Component D premiums, deductibles and also co-insurance.Medigap or Medicare Supplement insurance job to cover any kind of scarcities or "spaces" that Original Medicare (Components An and also B) does not pay for. By law, firms can only provide basic Medigap insurance policy plans.

Strategies An and B do not offer coinsurance for proficient nursing facility care, but the other strategies do use aid.

We get on a mission, offering with interest, objective and also a smile!

How Does Medigap Works Things To Know Before You Buy

To figure out the best fit, it is very important to recognize what makes these coverage alternatives various. It actually relies on your demands, and each type of plan can have advantages and disadvantages. To start, focus on what you're truly looking for, including out-of-pocket prices, prescription medication insurance coverage, fringe benefits and even more.

Fringe benefits: Several strategies offer insurance coverage for vision, dental, hearing and also more. Network selection: For the most affordable expenses, you ought to see physicians and wellness treatment service providers who belong of the plan's network. The majority of plans will certainly provide some sort of out-of-network insurance coverage, too however it could have greater cost-sharing.

Getting The Medigap To Work

Relying on your monetary scenario and also your healthcare demands, the plan that works ideal for you may alter in time yet registering in either a Medicare Advantage or Medicare Supplement plan can assist with prices not covered by Original Medicare.

Medicare Select is a type of Medigap policy that needs insureds to use details healthcare facilities as well as in many cases specific physicians (other than in an emergency) in order to be eligible for complete benefits. Apart from the constraint on healthcare facilities as well as companies, Medicare Select plans have to satisfy all the needs that relate to a Medigap plan.

When you make use of the Medicare Select network medical facilities and also providers, Medicare pays its share of approved costs and the insurance provider is responsible for all supplementary advantages in the Medicare Select plan. In general, Medicare Select policies are not called for to pay any type of advantages if you do not utilize a network carrier for non-emergency solutions.

The Medigap settlement choices might vary depending on the insurance firm, but below are some typical means to pay your Medigap premium:: You can set up automated settlements from your financial institution account so that your Medigap costs is instantly deducted each month.

The smart Trick of How Does Medigap Works That Nobody is Discussing

You will certainly not also see the expense but you may go to this website obtain an "description of billing" that reveals that paid what. If your Medigap plan does not cover the Part B insurance deductible and you have actually not yet satisfied your insurance deductible for the year, you will certainly require to pay that quantity before your Medigap plan will begin covering costs.

If, not you can click to read more contact your agent or the insurance coverage carrier straight.

While Medicare Part An and also Component B advantages originate from the federal government, Medicare Supplemental strategies have actually advantages supplied by private insurance policy providers. These providers expense Medicare first and bill the continuing to be total up to the Medigap carrier. In 47 states, Medigap strategies are recognized by letters A through N. Each lettered plan provides a different protection degree.

In addition, it is important to keep in mind that if you have a Medicare Supplement policy and also your partner needs insurance coverage, they need to purchase a different plan. Normally, Medicare Supplement prepares deal specific insurance coverage, so you as well as your partner can not share a plan. Not being able to share a policy offers much more positives than negatives for partners.

The Buzz on How Does Medigap Works

Ronald and also Carolyn are a wedded pair transforming 65 as well as enrolling in Medicare. Ronald is very healthy Resources and balanced as well as exercises on a daily basis. Carolyn was lately identified with cardiovascular disease and had difficulty strolling up as well as down the stairs in their residence. When enrolling in a Medicare Supplement strategy, Ronald desires something affordable to cover him in an emergency.

When you register in a Medicare Supplement plan during this moment, you have assured problem legal rights. This suggests pre-existing conditions can not influence your admission to the strategy. Carriers can not decline your insurance coverage based upon your wellness history. You might still enlist in Medicare Supplements outside your Medigap Open Enrollment Duration home window, however you may be subject to wellness inquiries.